It’s an obvious assumption that insurance companies don’t want you shop around. Insureds who shop around for the cheapest price will probably buy a different policy because there is a high probability of finding a lower rate. A recent survey discovered that people who routinely shopped around saved $3,400 over four years compared to other drivers who don’t make a habit of comparing rates.

If finding budget-friendly rates on auto insurance in Charlotte is your goal, understanding the best way to shop and compare insurance premiums can help make the process easier and more efficient.

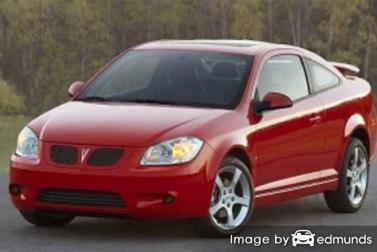

The best way we recommend to find low-cost prices for Pontiac G5 insurance is to do an annual price comparison from insurance carriers in Charlotte.

The best way we recommend to find low-cost prices for Pontiac G5 insurance is to do an annual price comparison from insurance carriers in Charlotte.

- First, get a basic knowledge of how auto insurance works and the measures you can take to prevent expensive coverage. Many risk factors that cause high rates such as traffic citations, accidents, and an unacceptable credit score can be amended by improving your driving habits or financial responsibility.

- Second, quote rates from direct, independent, and exclusive agents. Direct and exclusive agents can only quote rates from one company like GEICO or Farmers Insurance, while independent agencies can quote rates from multiple companies. View a list of agents

- Third, compare the new rate quotes to your existing policy and see if you can save money. If you find better rates and switch companies, make sure coverage does not lapse between policies.

- Fourth, give proper notification to your current agent or company of your intent to cancel the current policy. Submit the application along with any required down payment to your new company or agent. As soon as coverage is bound, put the new proof of insurance certificate along with the vehicle’s registration papers.

A good piece of advice is that you’ll want to make sure you compare similar coverage information on every quote and and to get quotes from as many companies as you can. This provides a fair price comparison and a complete selection of prices.

The purpose of this post is to teach you the best way to quote coverages and how you can save the most money. If you are insured now, you stand a good chance to be able to shop for the lowest rates using the ideas you’re about to read. Although North Carolina drivers need to have an understanding of the methods companies use to market insurance on the web and use this information to your advantage.

The fastest way that we advise to compare insurance rates from multiple companies is to know the fact car insurance companies will pay a fee to compare rate quotes. To begin a comparison, all you need to do is provide information such as if your license is active, how much you drive, which vehicles you own, and how much education you have. The data gets sent immediately to many of the top insurers and you should receive rate quotes instantly to find the best rate.

To check rates for your Pontiac G5 now, click here and complete the form.

The companies in the list below can provide price quotes in North Carolina. If multiple companies are listed, it’s a good idea that you visit as many as you can to get a more complete price comparison.

Choosing the best Pontiac G5 insurance in North Carolina is an important decision

Despite the high cost, auto insurance may be mandatory for several reasons.

First, almost all states have mandatory liability insurance requirements which means you are required to buy a minimum amount of liability in order to get the vehicle licensed. In North Carolina these limits are 30/60/25 which means you must have $30,000 of bodily injury coverage per person, $60,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

Second, if you took out a loan on your car, most banks will stipulate that you buy insurance to ensure the loan is repaid in case of a total loss. If you do not pay your insurance premiums, the lender may insure your Pontiac at a more expensive rate and require you to pay for it.

Third, insurance safeguards both your car and your personal assets. It will also provide coverage for many types of medical costs for not only you but also any passengers injured in an accident. As part of your policy, liability insurance also pays for attorney fees and expenses if anyone sues you for causing an accident. If mother nature or an accident damages your car, comprehensive (other-than-collision) and collision coverage will pay to restore your vehicle to like-new condition.

The benefits of buying auto insurance greatly outweigh the cost, especially for larger claims. Unknowingly, the average driver is currently overpaying as much as $750 every year so it’s important to compare rates each time the policy renews to save money.

Eight Things That Affect Your Insurance Rates

Consumers need to have an understanding of some of the factors that go into determining your premiums. When you understand what influences your rates, this enables you to make decisions that can help you get cheaper rates.

The items below are some of the most rate-impacting factors used by companies to determine rates.

- Drive less and save – The more you drive every year the higher your rate. Almost all companies charge rates based on their usage. Cars and trucks used primarily for pleasure use qualify for better rates than vehicles that have high annual mileage. Make sure your policy properly reflects how each vehicle is driven. An improperly rated G5 may be wasting your money.

- Safer cars cost less to insure – Safe vehicles tend to be cheaper to insure. Safe vehicles reduce the chance of injuries and reduced instances of injuries translates into fewer and smaller insurance claims which can result in lower premiums. If your Pontiac scored at minimum an “acceptable” rating on the Insurance Institute for Highway Safety website or four stars on the National Highway Traffic Safety Administration website you may be receiving a better rate.

- Tickets can increase prices – A bad driving record has a lot to do with how much you pay for insurance. Even a single chargeable violation can increase the cost of insurance by twenty percent. Careful drivers receive lower rates compared to drivers with tickets. Drivers who have gotten license-revoking violations like reckless driving, hit and run or driving under the influence may face state-mandated requirements to file a SR-22 with their state DMV in order to legally drive.

- Gender as a rate factor – Statistics have proven that men are more aggressive behind the wheel. This data doesn’t prove that females are better drivers. Men and women have at-fault accidents at a similar rate, but the males have accidents that have higher claims. Not only that, but men also get more serious tickets like DUI and reckless driving. Male teenagers cause the most accidents and therefore pay the highest rates.

- Use credit responsibly and save – An insured’s credit rating is a large factor in determining what you pay. If your credit can be improved, you could potentially save money when insuring your Pontiac G5 if you improve your credit rating. Drivers who have excellent credit tend to file fewer claims and have better driving records than those with lower credit scores.

- Companies want multiple policies – Most major insurance companies will give lower prices for people that have more than one policy. It’s known as a multi-policy discount. The amount of the discounts can be as much as ten percent or more Even though this discount sounds good, it’s always a smart idea to shop around to guarantee you are still saving the most.

- Decrease premiums by maintaining coverage – Allowing your car insurance policy to lapse is a fast way to drive up your policy premiums. And not only will insurance be more expensive, being ticketed for driving with no insurance can result in a fine, jail time, or a revoked license.

- Lower performance equals lower insurance rates – The performance of the car or truck you need insurance for makes a significant difference in determining your rates. Small economy passenger cars usually have the lowest premiums, but many other things help determine your insurance rates.

Be persistent and save

Cheap Pontiac G5 insurance in Charlotte can be found from both online companies and with local Charlotte insurance agents, and you need to price shop both in order to have the best price selection to choose from. Some insurance providers do not provide rate quotes online and these small, regional companies work with independent insurance agencies.

We just presented a lot of tips how to lower your Pontiac G5 insurance premium rates in Charlotte. It’s most important to understand that the more you quote Charlotte car insurance, the better your chances of lowering your prices. You may even discover the most savings is with some of the smallest insurance companies. Smaller companies can often insure niche markets at a lower cost than their larger competitors like Allstate or State Farm.

More tips and info about auto insurance is located in the articles below:

- Determining Your Vehicle’s Value and Repair Cost (Insurance Information Institute)

- Who Has Affordable Charlotte Auto Insurance Rates for Drivers Under 25? (FAQ)

- How Much are Charlotte Auto Insurance Rates for Uber Drivers? (FAQ)

- What Does No-Fault Insurance Cover? (Allstate)

- Help Your Teen Be a Better Driver (State Farm)